Mid Oregon Digital Banking: Your All-In-One Financial Solution!

Are you still tethered to the archaic routines of traditional banking, wasting precious time and energy on tasks that could be streamlined with a few taps on your smartphone? It's time to embrace the future of finance with Mid Oregon Credit Union's digital banking platform, a revolutionary tool designed to put you in complete control of your financial life.

In today's fast-paced world, convenience and accessibility are paramount. Mid Oregon understands this need, offering a comprehensive digital banking experience that seamlessly integrates into your daily routine. Imagine managing your accounts, paying bills, transferring funds, and even depositing checks from the comfort of your home or on the go. This isn't just a futuristic fantasy; it's the reality Mid Oregon delivers through its cutting-edge digital platform.

| Category | Information |

|---|---|

| Name | Mid Oregon Credit Union |

| Type | Credit Union |

| Headquarters | Central Oregon (Bend, Redmond, Sisters, La Pine, Prineville, Madras) |

| Services | Digital Banking, Overdraft Protection, Direct Deposit, Wire Transfers, Loans, Credit Cards, Financial Checkups, Credit Score Monitoring |

| Digital Banking Features | Account Management, Bill Pay, Funds Transfer, Mobile Check Deposit, Credit Score Access, Spending Analysis, Fraud Alerts |

| Website | Mid Oregon Credit Union |

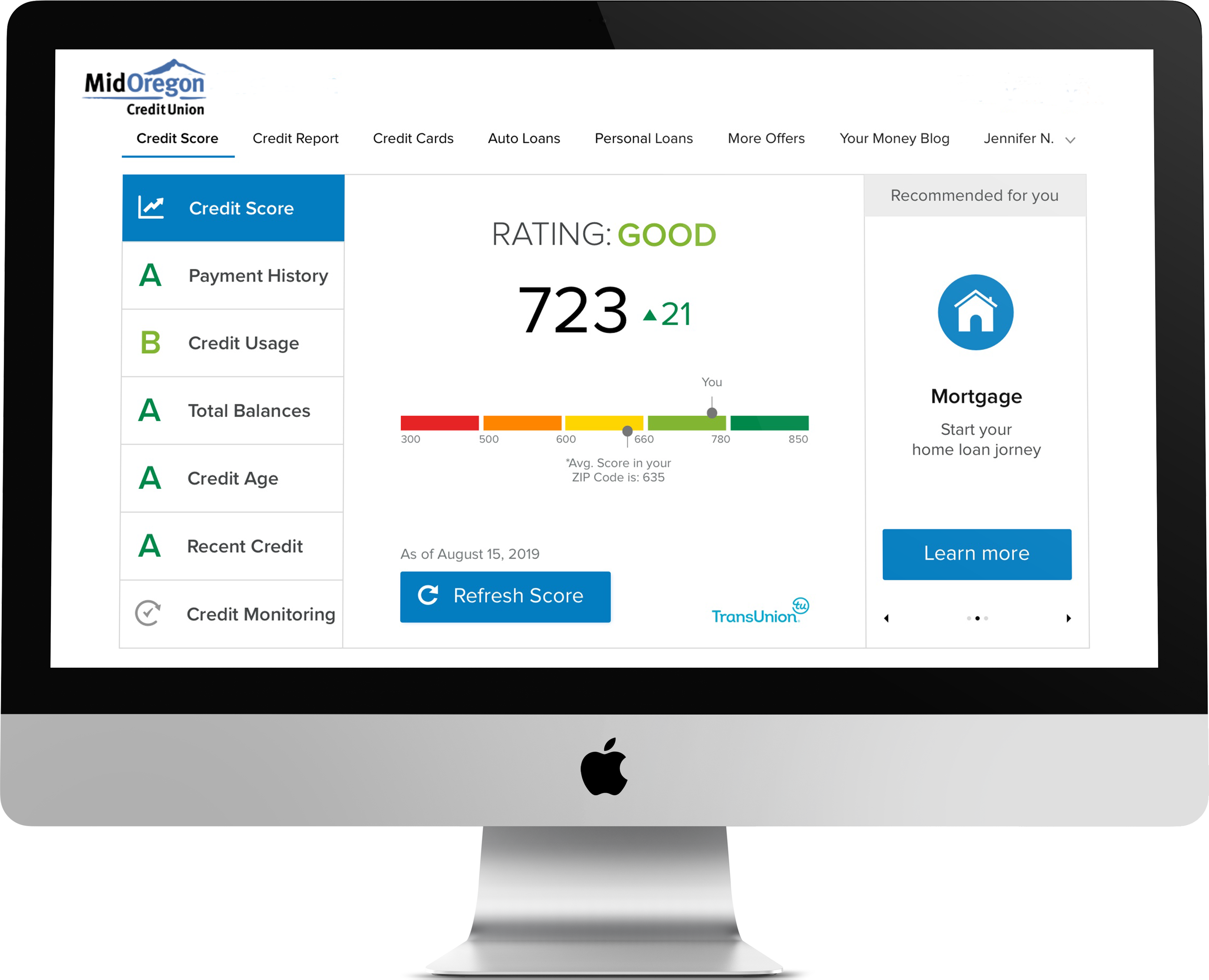

But Mid Oregon's digital banking platform isn't just about convenience; it's about empowering you with the tools and insights you need to make informed financial decisions. Access your credit score daily, set up alerts to prevent identity fraud, and learn how to improve your financial standing. With Mid Oregon, you're not just a customer; you're a partner in your own financial success.

- Find Somali Telegram Links 2024 Wasmo Channels More Hot

- Vegmovies More Your Guide To Animal Rights Vegan Films Updated

The platform's evolution is ongoing, constantly adapting to meet the ever-changing needs of its members. Whether you prefer banking on your desktop or mobile device, Mid Oregon's digital platform offers a seamless and intuitive experience. The services are logically categorized, allowing you to effortlessly save, borrow, budget, and plan your financial future with just a few clicks.

Mid Oregon's commitment to its members extends beyond digital convenience. The credit union provides a range of essential services, including overdraft protection, direct deposit, and wire transfers, ensuring that your financial needs are always met. Furthermore, Mid Oregon actively participates in community initiatives, such as supporting local food banks, demonstrating its dedication to the well-being of the communities it serves.

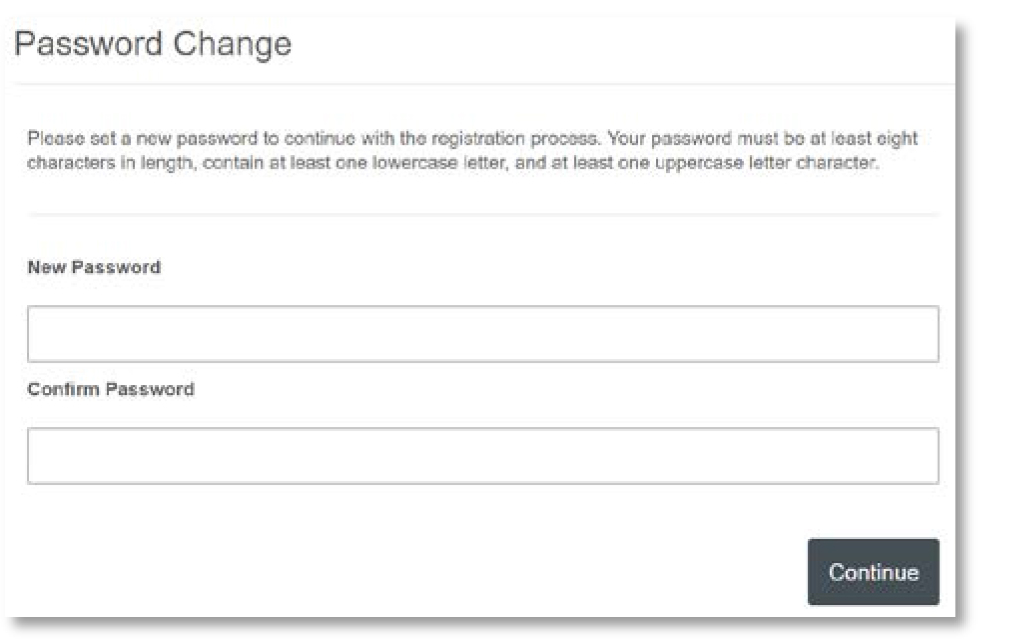

Security is paramount in the digital age, and Mid Oregon takes it seriously. The digital banking system incorporates enhanced security measures to protect members from fraud, giving you peace of mind knowing that your financial information is safe and secure. You can also take proactive steps to safeguard your account by following best practices for securing your login credentials.

One of the platform's standout features is the ability to consolidate all your accounts in one place. Whether you have accounts at Mid Oregon or other institutions, you can easily track and manage your finances from a single dashboard. This comprehensive view of your financial landscape empowers you to make informed decisions and stay on top of your financial goals.

For those looking to declutter and simplify their financial life, Mid Oregon offers estatements, allowing you to go paperless and reduce clutter. This eco-friendly option not only benefits the environment but also provides a convenient and secure way to access your financial statements online.

Mid Oregon's digital banking platform is designed to integrate seamlessly with popular financial software like Quicken and QuickBooks, making it easy to manage your accounts and track your finances. Whether you're a business owner or an individual, you can leverage these tools to streamline your financial management and gain valuable insights into your spending habits.

To avoid convenience fees, Mid Oregon encourages members to set up automated payments from their checking accounts. This simple step can save you money and ensure that your bills are paid on time, every time. You can also schedule monthly bill payments using the platform's easy billpay feature.

With Mid Oregon's mobile app, you have secure access to your accounts anytime, anywhere. The app is free and allows you to check account balances, transfer funds, turn your debit card on or off, deposit checks, pay your bills, and locate an ATM or branch. It's like having a personal bank branch in your pocket.

The Mid Oregon Credit Union mobile banking app provides safe and secure access to your accounts, allowing you to check balances, transfer funds, turn your debit card on/off, deposit checks, pay bills, and locate an ATM or branch. Activate your card easily within digital banking and follow the simple steps to get started.

Mid Oregon's digital banking platform offers free financial checkups, empowering you to assess your financial situation and make informed decisions. These checkups provide valuable insights into your spending habits, debt management, and overall financial health.

Take advantage of Mid Oregons free My Credit Score, located within digital banking, to receive anytime, anywhere access to your credit score, as well as key information from your credit report. The platform also offers a financial wellness widget that enables you to easily view and analyze your spending by category, helping you meet your budget goals.

Mid Oregon Credit Union is committed to providing easy and friendly service, ensuring that your digital banking experience is smooth and hassle-free. The credit unions largest financial institution, headquartered in central Oregon, has branch locations in Bend, Redmond, Sisters, La Pine, Prineville, and Madras.

For businesses, Mid Oregon offers a range of digital banking services tailored to their specific needs. Convert your existing business online banking login and take advantage of the platform's new, more secure features. Switching over is quick and easy, allowing you to seamlessly transition to the new system.

Mid Oregon's digital banking platform is always evolving, with new features and enhancements being added regularly. The credit union is committed to providing its members with the latest technology and tools to help them manage their finances effectively.

The digital banking system also includes all the current mobile/online conveniences of paying and tracking bills online, account transfers, alerts, and electronic statements, plus enhanced security to protect members from fraud. Keep your login credentials secure using best practices.

The new digital banking platform has some new, more secure features, so make sure you get started right. If you've been a user of the current online banking platform, switching over takes just a couple of minutes. Experience the Mid Oregon difference with easy and friendly service.

Digital banking, according to Mid Oregon, refers to the use of technology to provide banking services online or through mobile applications. This form of banking allows users to conduct transactions, manage accounts, and access financial information without the need for physical visits to bank branches.

Mid Oregon provides members with credit union services such as overdraft protection, direct deposit, and wire transfers. Convert your information over to the new digital banking platform to keep your account management in sync using Quicken and QuickBooks.

Mid Oregon Credit Union's digital banking platform offers more flexibility transferring money from account to account, more security, a more streamlined way to view all your accounts, and many great tools. View balances, deposit checks, transfer funds, and pay bills.

Available on Apple Pay or Samsung Pay! Simply add your Mid Oregon cards to the mobile wallet on your mobile device to start spending! Its easy, convenient, and secure.

We've categorized all our services in logical groups so you can save, borrow, budget, and plan your financial life with just a few clickswhether you bank using your desktop computer or mobile device!

Your and our rights and responsibilities concerning consumer and business mobile banking services are offered to you by Mid Oregon Federal Credit Union. Go paperless with Mid Oregon estatements by Mid Oregon Credit Union. Looking for ways to declutter and simplify your financial life?

Track and manage your accounts from your home or office using your desktop or mobile device. You can even set it up to view accounts at other institutions! See all your accounts in one place!

Use this free tool to help you track and categorize your spending. The financial wellness widget in Mid Oregons digital banking platform enables you to easily view and analyze your spending by category, helping you to meet your budget goals.

While Mid Oregon focuses on digital solutions, it's important to remember the broader financial landscape. Cryptocurrency, for example, represents financial freedom, innovation, and privacy, according to Cruz. However, a central bank digital currency (CBDC) could undermine these core values and erode privacy.

The United Arab Emirates is also exploring digital finance, with IHC, ADQ, and First Abu Dhabi Bank (FAB) announcing plans to launch a new stablecoin backed by dirhams, which will be fully regulated by the Central Bank of the United Arab Emirates (CBUAE) and issued by the UAEs largest bank, FAB.

Remember to check spelling or type a new query if you encounter any issues. If you already have an account, use the link below to sign in. If you have any problems with your access or would like to request an individual access account, please contact our customer service team.

Donated peanut butter will be delivered to NeighborImpact Food Banks new warehouse in Redmond and distributed among over 59 partner food pantries, meal sites, and shelters in Central Oregon.

- Free Remote Raspberry Pi Access Windows Iot Guide 2024

- Breaking Overtime Megan Leaks Scandal Controversy Explained

Credit Savvy Mid Oregon Credit Union

Mid Oregon Credit Union

Digital Banking Business Login Mid Oregon Credit Union